Converting low value banking customers using digital services

Most banks know the profitability of their existing customer base. They would have done deep analysis using their customer relationship management (CRM) tool or from market research to produce perceptual maps of customers based on behaviour or psychographic variables.

Some research have indicated 20% of a bank’s customers contributed to 80% of their profits. With this it would be fair to say all banks have been focused on retaining and finding ways to grow the top 20% of customers who are generating the most profits. What about the other 80% of the remaining customers who do not generate much profit or worst generating loss for their bank.

Example of possible low value customer segments:

- They only maintain a low balance transaction savings account;

- They are students or young adults (and current product offering may be of value to this segments);

- They have not opened other higher margin products in their portfolio;

- They still use paper checks or passbook and prefer to access higher-cost channels (i.e. branches, IVR) for service;

It is understandable these customer segment is not a focus for the bank for profitability and growth. However today’s mobile technologies can enable banks to create new digital banking services which may be better suited to serve these low value segment.

What are some of the possible digital banking services?

A new digital cash only account that complements existing savings or transactional account. This new bank account would be associated with the customer’s mobile phone number and be accessible via their mobile phone. This new product could appeal to the younger generation and be a lower-cost and service option for the bank to service above mentioned segments as well as existing customers who may want to take this offering.

Although this digital offering may generate less fees or/and have zero deposit interest than a traditional savings account, the bank would be able to participate in the customer’s digital cash transactions which are funded from this account. These includes online Ecommence transactions, Bill Pay or Peer-to-Peer transfer.

Another is enabling the use of SMS for payments. These would suit the segment who does not have debit Mastercard or a credit card but who does own a mobile phone.

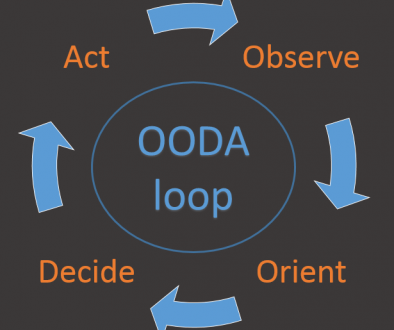

With this, it will hope this will be change customer behvaiour for them to become comfortable with the notion of paying more frequently with digital cash and writing less checks or visiting the branch. In other words adding the bank’s digital services to the customer’s set of evaluation criteria in the customer buying decision process.

In conclusion, with the Australian population using mobile devices, banks can leverage the use of a new digital account or using SMS for payments to offer innovative and cost-effective services to covert from unprofitable customers to profitable customers. The positioning of the services is to create value for customers in terms of convenience, fast and secure benefits and value for the bank in terms of lower cost service and retaining their customer base.